FreshBooks Review: Is It the Right Accounting Software for You?

Managing business finances can be overwhelming, especially if you’re a freelancer or a small business owner juggling multiple tasks at once. This is where FreshBooks comes in. It promises to simplify invoicing, expense tracking, and accounting, all while making sure you get paid on time.

But is it really as good as it claims? Let’s dive deep into FreshBooks, exploring its features, pricing, pros and cons, and how it stacks up against competitors. By the end, you’ll know whether FreshBooks is the right fit for your business.

What is FreshBooks?

FreshBooks is a cloud-based accounting solution tailored for freelancers, self-employed professionals, and small business owners. It simplifies financial management by offering a streamlined interface that allows users to manage essential business operations efficiently. Designed with ease of use in mind, FreshBooks helps entrepreneurs stay organized and focused on their work rather than getting bogged down by complex accounting processes.

The platform facilitates seamless financial tracking by integrating essential tools in one place. It enables users to maintain oversight of their business finances without the need for extensive accounting knowledge. The ability to handle multiple aspects of financial management in a single system contributes to an organized and structured workflow, ensuring that business operations run smoothly.

FreshBooks also supports collaboration by allowing team members and clients to engage with financial documents effortlessly. Business owners can manage their records and communications without unnecessary delays, keeping financial interactions transparent and accessible. This level of connectivity enables professionals to stay informed and maintain control over their financial status at all times.

By centralizing financial information, FreshBooks helps users maintain accurate records and improve business efficiency. The ability to access financial data from anywhere ensures that entrepreneurs and professionals can make informed decisions without being tied to a specific location. This flexibility is particularly beneficial for individuals who manage their businesses on the go or work with remote teams.

With its emphasis on accessibility and organization, FreshBooks supports professionals in maintaining control over their financial responsibilities. Its structured approach to business finances allows users to manage their workflows efficiently, ensuring that financial tasks are handled with minimal stress and maximum efficiency.

FreshBooks Features: All-in-One Financial Management

Now, let’s break down the features in detail.

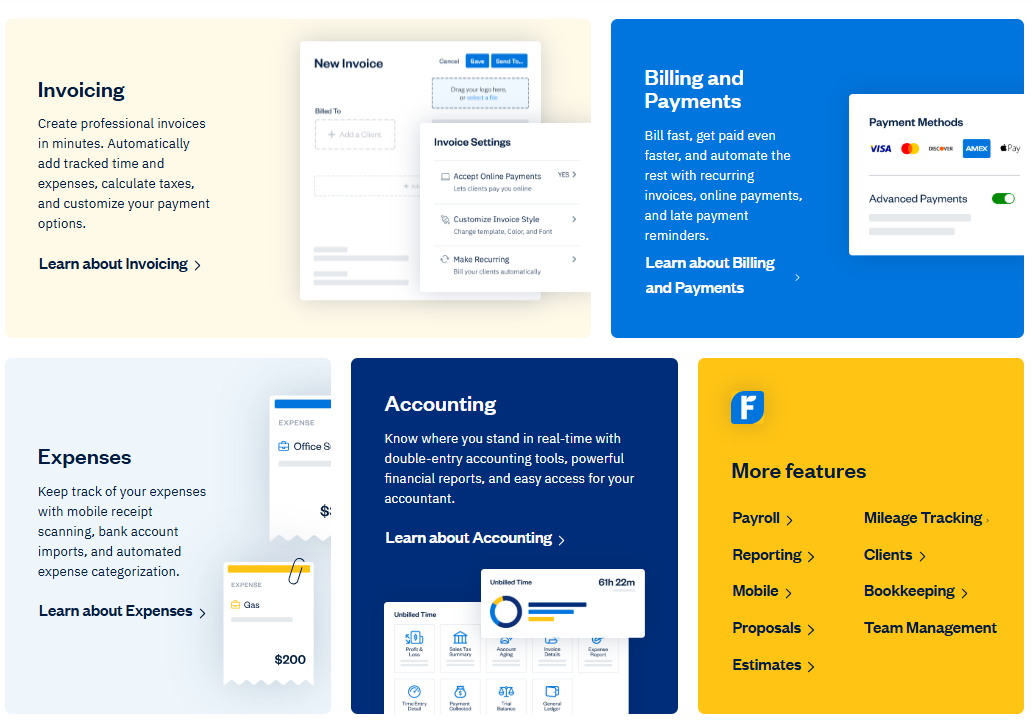

1. Invoicing: Professional and Hassle-Free

Creating and managing invoices is an essential task for any business, and FreshBooks makes it easy. With its user-friendly invoicing system, you can:

- Generate professional-looking invoices in minutes.

- Customize invoices with your logo, branding, and preferred payment terms.

- Automatically calculate taxes and add late fees when necessary.

- Accept online payments through credit cards and bank transfers (ACH).

- Set up recurring invoices for clients with ongoing projects.

- Send automated payment reminders for overdue invoices.

The ability to automate these invoicing tasks saves valuable time and ensures that payments are collected efficiently. Instead of manually following up with clients, FreshBooks handles reminders and overdue notifications, making cash flow management seamless.

2. Billing and Payments: Get Paid Faster

Chasing payments can be frustrating for freelancers and small business owners. FreshBooks simplifies this by integrating various payment options and automation, ensuring a smoother transaction process. You can:

- Accept credit cards and ACH bank transfers online for faster payments.

- Send automatic late payment reminders to clients.

- Offer recurring billing options for subscription-based businesses.

- Access detailed reports on paid and unpaid invoices.

With FreshBooks, payment delays are minimized, and the software helps eliminate the awkwardness of reminding clients about overdue balances. The automated reminders ensure that invoices are addressed promptly, improving cash flow for your business.

3. Expense Tracking: Keep Every Dollar Accounted For

Keeping track of expenses is crucial for maintaining profitability. FreshBooks offers several tools to help manage business expenditures without the need for spreadsheets or manual tracking. You can:

- Link your bank account to automatically import expenses.

- Snap a photo of receipts using your phone and have them logged automatically.

- Categorize expenses with smart automation, making tax season easier.

- Track expenses in multiple currencies if working with international clients.

By automating expense tracking, FreshBooks ensures that every dollar is accounted for. This makes financial reporting more accurate and reduces the chances of missing deductions when preparing taxes.

4. Accounting: Real-Time Financial Insights

For those who dislike bookkeeping, FreshBooks offers a simple yet powerful accounting solution. The system is built with a double-entry accounting framework, ensuring that financial records are accurate and compliant. With FreshBooks, you can:

- Track profits and losses with real-time financial reports.

- Generate tax-ready reports for easy tax filing.

- Give your accountant direct access to your books.

- Reconcile bank transactions to ensure financial accuracy.

Staying on top of your business finances is much easier with automated accounting tools. With just a few clicks, you can access critical reports and gain insights into your financial health, preventing last-minute tax surprises.

5. Time Tracking: Bill for Every Hour Worked

For service-based businesses, accurate time tracking is essential for ensuring that billable hours are recorded and invoiced correctly. FreshBooks offers built-in time tracking that allows users to:

- Log time for different projects and clients.

- Automatically add billable hours to invoices.

- Use a built-in timer to track work in real time.

This feature helps professionals who charge by the hour, ensuring that they are compensated for every minute of work performed. With automatic time logs, there’s no need to rely on memory or manual records.

6. Other Notable Features

Beyond core accounting tasks, FreshBooks provides additional tools to enhance business operations, including:

- Payroll Services (via Gusto integration) for employee and contractor payments.

- Mileage Tracking to simplify tax deductions for business travel.

- Detailed Financial Reporting for deeper insights into income, expenses, and cash flow.

- Client Management Tools to keep track of customer interactions and transactions.

- Mobile App for managing finances on the go.

- Project & Team Collaboration Tools to streamline teamwork and communication.

These additional features make FreshBooks a well-rounded solution for freelancers and small businesses that need more than just basic accounting. By integrating payroll, mileage tracking, and team collaboration, FreshBooks helps business owners manage multiple aspects of their financial operations in one place.

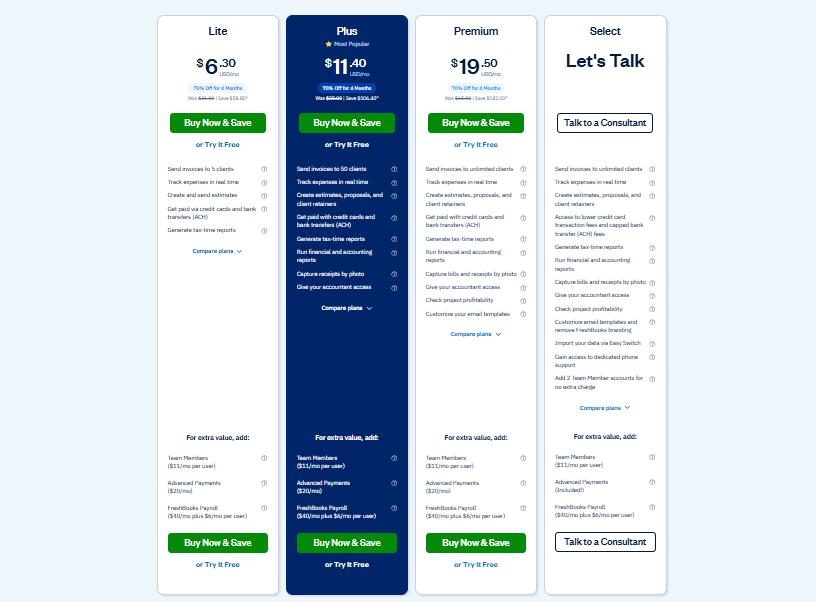

FreshBooks Pricing: How Much Does It Cost?

FreshBooks offers multiple pricing plans tailored to different business needs. Whether you’re a freelancer, small business owner, or growing enterprise, you can choose a plan that fits your invoicing and accounting requirements.

1. Lite – $6.30/month (70% Off for 4 Months, Then $21/Month)

The Lite plan is ideal for freelancers or solo entrepreneurs who need basic accounting tools. With this plan, you can:

- Send invoices to up to 5 clients.

- Track expenses in real time.

- Accept online payments via credit cards and ACH transfers.

- Generate tax-time reports for easier filing.

If you manage only a few clients and need a simple way to track finances, the Lite plan provides an affordable entry point into FreshBooks.

2. Plus – $11.40/month (70% Off for 4 Months, Then $38/Month)

Designed for growing businesses, the Plus plan offers more flexibility and advanced features. It includes:

- The ability to send invoices to up to 50 clients.

- The option to create proposals and set up client retainers.

- Receipt capture via the FreshBooks mobile app.

- Financial reporting tools for tracking business performance.

This plan is perfect for businesses that manage multiple clients and require more robust invoicing and expense tracking.

3. Premium – $19.50/month (70% Off for 4 Months, Then $65/Month)

The Premium plan is best suited for businesses with a larger client base and more complex financial needs. It offers:

- Unlimited client invoicing.

- Tools to check project profitability.

- Customizable email templates for personalized communication.

For businesses that handle numerous projects and want deeper financial insights, the Premium plan provides the necessary tools.

4. Select – Custom Pricing

FreshBooks also offers a Select plan for larger businesses that require advanced features and personalized support. This plan includes:

- A dedicated account manager for priority support.

- Lower transaction fees for online payments.

- Custom pricing based on your business’s specific needs.

If your business requires high-volume transactions, multiple team members, or more advanced financial management, the Select plan provides a tailored solution.

Add-Ons for Extra Functionality

FreshBooks allows you to customize your plan with additional features:

- Team Members: $11/month per additional user.

- Advanced Payments: $20/month for extra payment processing options.

- Payroll Services: $40/month + $6 per user, integrated with Gusto.

These add-ons are ideal for businesses that need to collaborate with team members or manage payroll efficiently.

Free Trial and Payment Options

While FreshBooks does not offer a free plan, they provide a 30-day free trial for new users. This allows you to test the platform’s features before committing to a subscription.

With flexible pricing and scalable features, FreshBooks ensures businesses of all sizes have the right tools to manage their finances effectively.

Pros & Cons of FreshBooks

Pros

- Super easy to use

- Automates invoicing & payment reminders

- Mobile-friendly

- Excellent customer support

- Expense tracking & bank reconciliation

Cons

- Limited features for larger businesses

- No built-in inventory management

- Extra cost for team members

- No free plan

- Limited customization options

Managing finances is crucial for freelancers and small businesses, and the right accounting software can make a big difference. This platform offers a user-friendly experience, automation, and excellent support. However, it may not be the perfect fit for every business. Let’s break down the pros and cons.

Pros

✔ Easy to use—perfect for freelancers & small businesses.

The platform is designed with simplicity in mind, making it easy for those without accounting expertise to manage their finances. The intuitive interface ensures smooth navigation and a quick learning curve.

✔ Automates invoicing & payment reminders.

You can set up recurring invoices and automatic payment reminders, reducing the chances of late payments and keeping cash flow steady. This feature saves time and eliminates the need for constant follow-ups.

✔ Mobile-friendly—manage finances from anywhere.

With a mobile app, you can check reports, send invoices, and track expenses on the go. This flexibility is ideal for business owners who need to manage their finances remotely.

✔ Excellent customer support.

The platform is known for its responsive and knowledgeable customer service team. Whether through chat, email, or phone, users receive timely assistance whenever issues arise.

✔ Seamless expense tracking & bank reconciliation.

Automatically import transactions from bank accounts, categorize expenses, and match them with invoices. This ensures accurate financial records and simplifies tax preparation.

Cons

✘ Limited features for larger businesses.

While great for small businesses and freelancers, the platform lacks advanced accounting tools needed by larger companies, such as in-depth financial forecasting and enterprise resource planning (ERP) integration.

✘ No built-in inventory management.

Businesses that handle physical products may struggle since the software doesn’t include inventory tracking. You’ll need third-party integrations or separate software to manage stock levels.

✘ Extra cost for team members.

If you need multiple users on the platform, expect additional fees. Unlike some competitors that include multiple users in their base plans, this software charges per team member.

✘ No free plan.

Unlike some accounting tools that offer a free tier, this platform requires a paid subscription. This might not be ideal for startups or freelancers on a tight budget.

✘ Limited customization options.

Customization for invoices, reports, and dashboards is somewhat restricted. If you need highly tailored financial documents or detailed reporting features, you may find this software lacking.

How Does FreshBooks Compare to Competitors?

Choosing the right accounting software depends on your business needs. Below is a quick comparison of FreshBooks, QuickBooks Online, and Xero based on key features.

| Feature | FreshBooks | QuickBooks Online | Xero |

|---|---|---|---|

| Ease of Use | ✅ Very Easy | ❌ Moderate | ❌ Moderate |

| Invoicing | ✅ Excellent | ✅ Excellent | ✅ Good |

| Expense Tracking | ✅ Yes | ✅ Yes | ✅ Yes |

| Payroll | ✅ Add-on | ✅ Built-in | ✅ Add-on |

| Pricing | 💲 Lower | 💲 Higher | 💲 Similar |

| Best For | Freelancers & Small Businesses | Larger Businesses | Mid-Sized Businesses |

Which One Should You Choose?

If you’re a freelancer or small business owner, FreshBooks is the easiest to use, with excellent invoicing and expense tracking at a lower cost. However, it lacks advanced features like built-in payroll or inventory management.

For larger businesses, QuickBooks Online is a better option as it includes built-in payroll and more advanced accounting tools, though it comes at a higher price.

For mid-sized businesses, Xero offers a balance between features and cost, with strong expense tracking and invoicing but a moderate learning curve.

Ultimately, FreshBooks is best for simplicity, while QuickBooks and Xero cater to businesses needing more complex financial management.

Final Verdict: Is FreshBooks Worth It?

If you’re a freelancer, self-employed professional, or small business owner, FreshBooks is a fantastic choice. It simplifies accounting, automates invoicing, and saves you valuable time.

However, if your business has complex inventory needs or large teams, FreshBooks might feel limited compared to QuickBooks or Xero.

Should You Get FreshBooks?

✅ Yes, if you want simple, automated accounting. ❌ No, if you need advanced accounting & inventory tracking.

FreshBooks is a powerful finance tool for small businesses, but what about investment or tax tools? Explore different finance tool categories here.